Avoid these Crypto Newbie Mistakes

Buying crypto on a centralized exchange is pretty straight forward. However, withdrawing funds to self-custody wallets and transacting with Dapps and smart contracts out on the blockchain can be confusing.

There’s a steep learning curve for more complex uses of crypto. This invites plenty of opportunities to make frustrating mistakes that can cost you both time and money.

I’m going to share some of the newbie mistakes I made with crypto. Hopefully, you can learn from my mistakes and avoid making them yourself.

In this article, I’ll cover these common crypto newbie mistakes:

Not saving enough to cover gas fees

Experiencing failed transactions when trying to stake some coins or transact with a protocol?

One way to invest in the Olympus DAO protocol is through buying $AVAX tokens which are swapped for $OHM and staked to earn rewards. Initially, I funded my wallet by buying some $AVAX on Coinbase and sending it over to my MetaMask wallet.

When swapping $AVAX for $OHM tokens, all I had in mind was the money I planned to rake in from the staking rewards. So, without thinking about it, I accidentally swapped all of the $AVAX in my wallet to buy as much $OHM as possible.

I completely overlooked saving some $AVAX to cover gas fees.

Since I was buying $OHM tokens on the Avalanche chain, I should have saved some $AVAX to cover transaction gas fees. Without $AVAX in my wallet, I couldn’t complete the swap transaction.

This is a simple mistake that’s easily avoided.

Because of this mistake, I had to buy more $AVAX and send it to my wallet. This wasted fees for the extra transactions. Alternatively, I could have swapped some OHM back to AVAX, but this would also be a waste of money spent on additional transaction and networks fees.

Bottom Line: Always remember to save some tokens to cover gas fees. Save extra native tokens of whatever blockchain you’re working with.

Withdrawing funds to the wrong network

I wanted to deposit funds into the PoolTogether protocol (an interesting lottery project) on the Polygon (aka the MATIC) Network. So, I bought some $MATIC tokens through Binance.US exchange.

Upon withdrawing my $MATIC tokens to my MetaMask wallet, I was given the option to withdraw the funds on ERC-20 (ETH network) or BEP-20 (Binance Smart Chain).

I had no idea that $MATIC had to be withdrawn to the MATIC mainnet where the protocol existed.

Not realizing this, I chose to withdraw my $MATIC on the BSC network as BEP-20 because the fees looked enticing – they were a lot cheaper than if I were to withdraw as ERC-20 instead.

I didn’t consider the fact that I’d have to go through the process of bridging the $MATIC tokens over to the correct chain from BSC to Polygon.

Bottom Line: Always make sure that you are withdrawing funds to the appropriate blockchain. Some exchanges do not allow certain cryptos to be withdrawn to their native blockchain. Make sure the crypto you’re buying on an exchange is able to be withdrawn to the chain of your choice. Otherwise, you need to know if and how it can be bridged to the appropriate chain.

Binance has only recently allowed $MATIC to be withdrawn to the Polygon mainnet. Previously, $MATIC could only be withdrawn to ETH or BSC networks.

Coins stuck on the wrong chain

If you withdraw or send crypto to an address on a blockchain where you don’t have any of that chain’s native tokens, you won’t be able to make any transactions and your your tokens will get stuck.

This is sometimes referred to as “painting yourself into a corner”.

When I withdrew $MATIC from Binance to my wallet on the BSC network, my crypto got stuck. I had to buy some $BNB to eventually bridge $MATIC over to the Matic mainnet.

I didn’t consider the fact that transacting on the BSC network used gas fees paid in $BNB tokens. At the time, I didn’t even know what $BNB was. All I knew is that I needed my $MATIC on it’s native Matic network.

I also needed $BNB to cover the gas fees for contract approval to use the bridge in the first place.

Bottom Line: Always keep some of a chain’s native token to cover gas fees.

Not meeting exchange withdraw limit

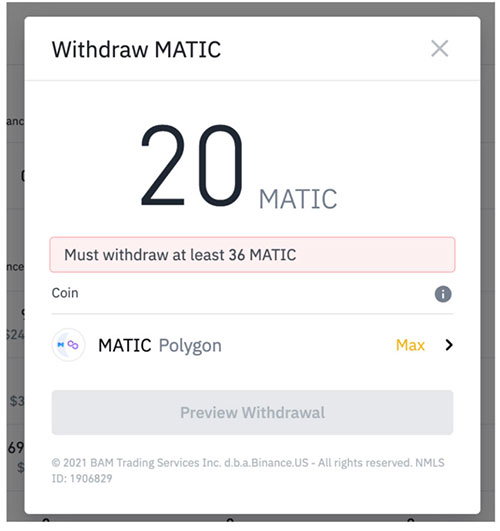

I hit a snag my first time ever trying to withdraw crypto from my Binance.US account.

Shortly after buying some $MATIC, I figured let’s test withdrawing a tiny amount to my MetaMask wallet just to be safe. Something as small as 20 $MATIC sounded fine.

To my surprise, Binance wouldn’t let me withdraw 20 $MATIC tokens to my MetMask wallet.

Then I discovered that there’s withdrawal minimum of at least 36 MATIC.

To fix this, I had to buy more $MATIC than I had planned just so that I could with draw the funds to my wallet.

Bottom Line: Every exchange has their own withdrawal limits. These limits can vary depending on the cryptocurrency or token. Make sure you know the withdrawal limits before transacting or your coins might get stuck in your account until you can buy more to meet the minimums for withdrawal.

You can check Binance withdrawal limits and fees here.

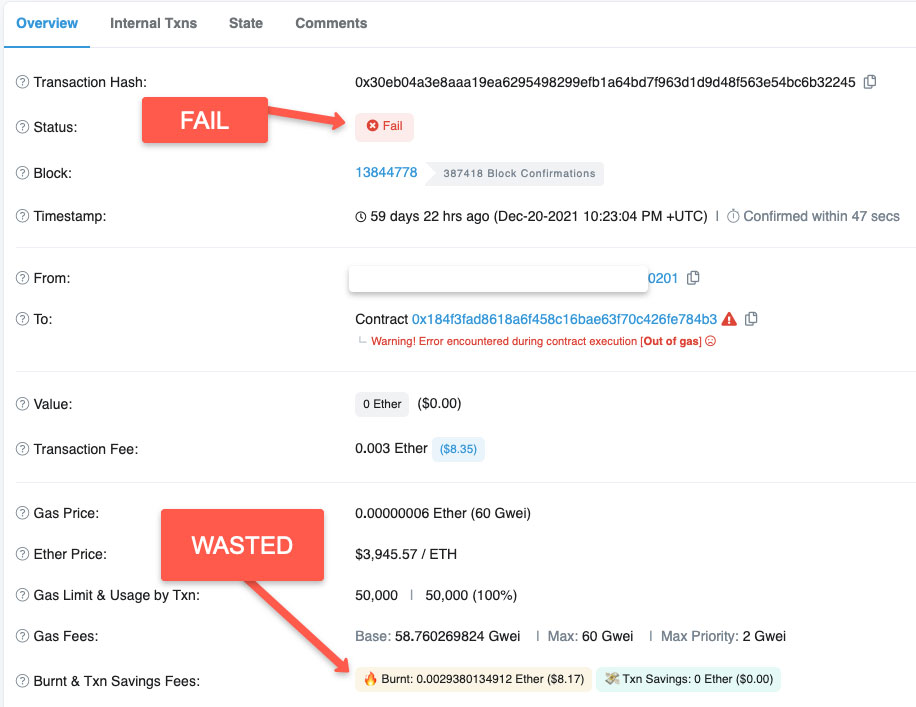

Wasting ETH gas on failed transactions

Mistakes on the Ethereum blockchain can be costly. Especially when it comes to wasting gas fees which does nothing but burn a hole in your wallet. It’s frustrating as shit.

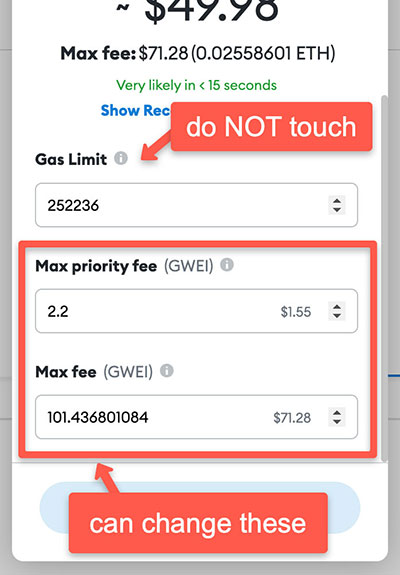

Be especially careful when editing your MetaMask custom gas settings.

As an example, I tweaked some settings that caused my transaction to fail instantly while still costing me a bunch in ETH gas.

Here’s my failed transaction:

This happened when I tried to approve migrating from from Olympus DAO’s sOHM token to their new gOHM governance token.

Sometimes a protocol that you’ve invested in will make updates to their contracts. And sometimes, these updates force you to make some transactions that you may be unsure of how to do properly.

It will happen at some point with any new DeFi project.

Crypto evolves so fast that you have to get comfortable with learning a bunch of processes to transact and invest confidently.

If you’re messing with MetaMask settings, don’t change the gas limit. Only touch the max fees for gas and/or priority fees.

Bottom Line: When in doubt, use MetaMask’s recommended gas settings instead of making manual adjustments.

BTW, if you enter a max fee that’s too low for the transaction to go through, it may cause the transaction to get hung up in a pending state just sitting there. You might have to cancel the transaction which will waste some gas.

Check this article on speeding up and cancelling transactions to minimize wasting fees.

Not following withdrawal waiting period

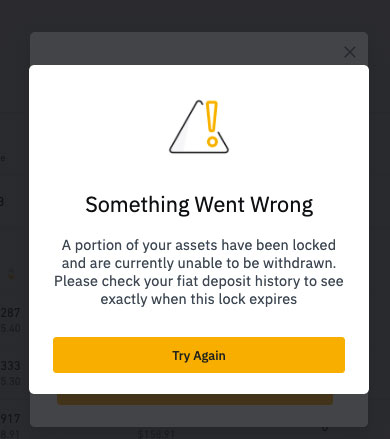

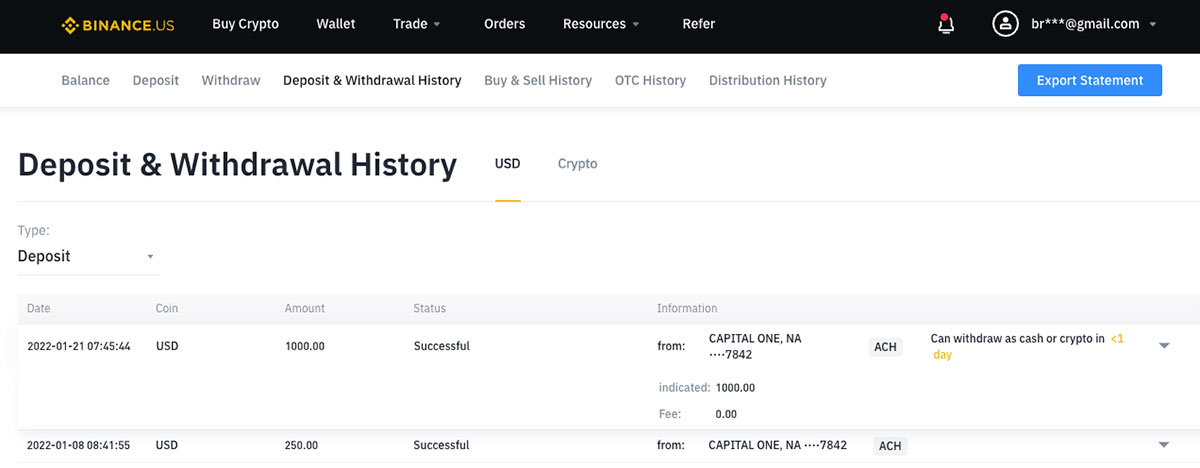

When you make an ACH deposit into Binance, there’s a 10-day waiting period before you will be able to withdraw your funds. This limit applies to both fiat and crypto.

When I wanted to withdraw $AVAX to my MetaMask wallet to pull the trigger on a crypto play, I was only able to withdraw a small portion of my funds.

When I tried to withdraw the remaining amount, I encountered this warning that my crypto is still locked:

After checking my fiat deposit history, I could see that I was less than one day short of being able to withdraw. Fortunately, I just had to wait a few hours.

So close, yet so far – especially when you’re ready to get moving or you see a good entry price. Time is of the essence!

Check FIAT deposits for withdraw restrictions

Bottom Line: If your funds are ever locked, preventing you from withdrawing either fiat or crypto out of Binance, check your Binance deposit history log to see how much time is left on the locked fund timer. Withdrawal restrictions can vary across different exchanges. Make sure you know what the restrictions are ahead of time.

Sending tokens to the wrong protocol

Fortunately, I didn’t make this mistake, but I’ve seen others do it too many times to count.

When I first became interested in the Olympus DAO project I joined their Discord server. After spending enough time lurking the Discord, I watched people blow thousands of dollars instantly by sending their tokens to the wrong contract by accident.

Here’s one example I saw of someone who instantly blew over $5k:

This user in the Olympus Discord accidentally sent 10 $OHM tokens directly to the Olympus protocol address instead of using the Olympus Dapp dashboard to properly stake their tokens.

At the time, each $OHM token was worth over $500. That’s $5000 lost in an instant for a careless mistake.

Bottom Line: Double check the address you’re sending to and the instructions for how a protocol is meant to be used. DeFi projects typically use a Dapp dashboard for transactions like staking as opposed to sending crypto to the protocol’s address directly. There’s a difference here.

Fake crypto support and Dapps

Fortunately, I learned quick enough to safeguard myself against falling victim to common crypto scams and phishing attempts.

I’ve seen many users on Discord and on Reddit complain about how their wallets got “hacked”.

More often than not, this was usually a case of the user either accidentally connecting to a fake Dapp or giving away their seed phrase to someone posing as a “support agent” that offered to help resolve their issues. Fake MetaMask and DeFi project support is really common.

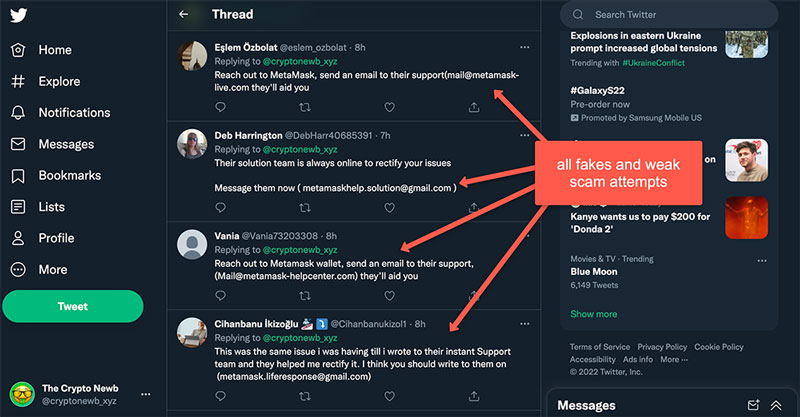

Crypto scams are insanely common across the web including fake google ads, across Twitter, Reddit and in Discord servers.

I once tweeted about an issue I was having where I set a custom gas fee in MetaMask that was too low which caused a transaction to get stuck on pending. Within a matter of seconds, my tweet was shockingly retweeted, liked, and commented on by a dozen scammers:

Bottom Line: Only use official links where possible and bookmark them. Double check the identity of who you communicate with and never give away your seed phrase or private keys. Start using a crypto hardware wallet too.

Check this article on common crypto scams so you can be sure to avoid them.