I bought my first crypto ever using the CoinBase platform. It’s one of the most popular and user-friendly exchanges to start buying crypto in the U.S.

Once I got more comfortable buying crypto, and as I started doing it more often and looking for more cyrpto currency tokens, it made sense to start looking into other crypto exchanges.

Here’s some popular exchanges that I’ve come across and started using.

Let’s explore some of the pros and cons that I’ve discovered with these popular central exchanges.

In this article, we’ll cover:

Coinbase Crypto Exchange

Coinbase is one of the most popular and user-friendly crypto exchanges. Everyone’s heard of Coinbase. They are very popular in the U.S. and considered one of the most trusted crypto exchanges.

There’s a paid version of Coinbase PRO, but since I haven’t used that, we’ll focus on the basic, free version of Coinbase.

PROs and CONs of using Coinbase

- simple signup process

- user-friendly interface

- secure central exchange based in the U.S.

- works as your digital wallet

- funds protected by theft insurance

- access to a wide variety of cryptos

- publicly traded company

- quizzes to earn free tokens

- signup bonus

- great mobile app

- high trading fees

- limited access to altcoins

- limited trading features

Coinbase fees

Coinbase fees are a bit tricky to understand. It’s also frustrating that these fees are hard to find on their website. You’ll have to do some digging.

It’s easiest to summarize Coinbase fees like this:

- For each trade up to $10, you can expect to pay about $1.

- For trades between $10 to $200, you’ll pay up to about $3.

- For trades over $200, there’s about a 1.5% fee when using your bank account or USD wallet as the payment method.

Compared to other exchanges, Coinbase isn’t the cheapest exchange, but it’s a great place to get started with crypto.

I used Coinbase to purchase ETH, USDC, and AVAX for my first on-chain transactions outside of an exchange. This was super exciting when you do it for the first time.

It involves getting a digital wallet like MetaMask and moving funds off an exchange so you can interact with Dapps connected to blockchains like Ethereum, AVAX, or MATIC for example.

For newbies though, Coinbase is a great place to start learning about coins and how buying/selling crypto works in the most frictionless way possible.

Read this guide to learn more about how easy it is to start buying your first crypto using Coinbase.

Binance (US) Crypto Exchange

Binance is one of the largest central exchanges in the world.

It’s cheaper than Coinbase and has more advanced features, but comes with its own quirks.

Since I’m based in the U.S., I will focus primarily on Binance.US (as opposed to Binance.com for international customers).

PROs and CONs of using Binance

- user-friendly interface

- secure central exchange based in the U.S.

- works as your digital wallet

- access to a wide variety of cryptos

- discounts for holding $BNB

- allows limit orders

- slow customer support

- 10-day lockup period

- confusing withdrawal limits

The great thing about Binance is that it’s easy to use with a mostly clean interface. I say mostly because their trading platform looks intimidating at first and the website’s interface can be a bit glitchy. The navigation is also a little weird.

However, their trading fees are much cheaper than Coinbase.

Binance fees

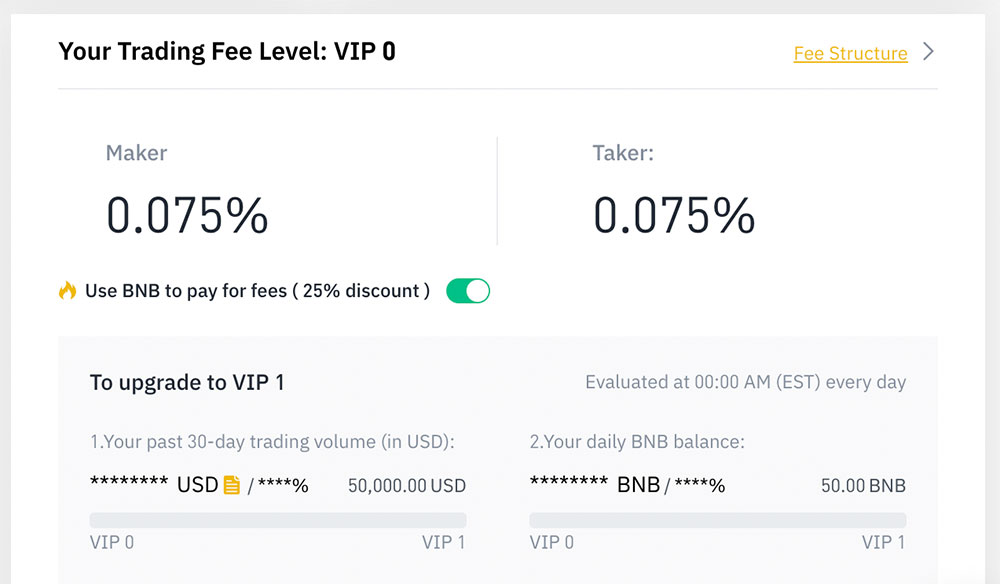

Binance’s fee structure is based on different tiers depending on how much you trade.

For most customers, this won’t make a difference unless you’re trading in the high 5-figures frequently (like if you’re balling out making $50,000 trades).

In most cases, new customers will benefit from 0.075% trading fees.

You’ll also have access to a larger set of altcoins versus CoinBase.

Funding your account is easy with Binance. You can simply connect your bank account and make an ACH deposit to start buying crypto immediately. You can also buy crypto directly with your linked account.

Trading fee discounts

Binance offers additional trading fee discounts if you hold their $BNB token. There’s an option to pay fees in BNB instead of whatever crypto currency you’re buying or spending from your USD wallet.

Last I checked, you have to hold at least $50 worth of BNB for the discount.

Fund lockout periods

One of the major downsides with Binance is the lockup periods where you can’t withdraw funds from your account for at least 10 days (when using ACH deposits).

Binance explains it here:

Please note, you will not be able to withdraw the USD equivalent of this deposit (including the equivalent sum in crypto) for 10 days after initiating an ACH deposit, and 5 days after initiating a Debit Card deposit. The hold can be easily calculated by subtracting the total USD value of your deposits on hold from your account’s total USD value at any given time.

Source: Binance

Basically, what this means is that If you were to deposit $1000 USD into your Binance account, then you bought $1000 worth of crypto, you’d have to wait at least 10-days before you can withdraw it. You will not be able to send your crypto to another wallet outside of the exchange until the timer is up.

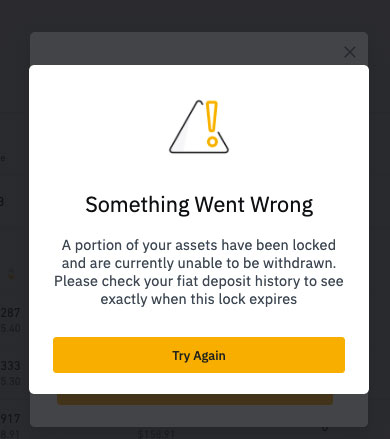

I learned about the lockup timer the hard way. Upon making a big AVAX purchase, expecting to withdraw it immediately to my MetaMask wallet, and start investing in a DeFi project I was super excited about, I was instead greeted with this fantastic notice:

Fortunately, I was on day 9 out of the 10 day lockup and only had to wait a few hours before I could withdraw funds to my MetaMask wallet.

This can drive you crazy when you’re hyped on a project. It can also cause you to miss out on a great entry price of a token as crypto moves fast and doesn’t sleep like the stock market.

Minimum withdrawal requirements

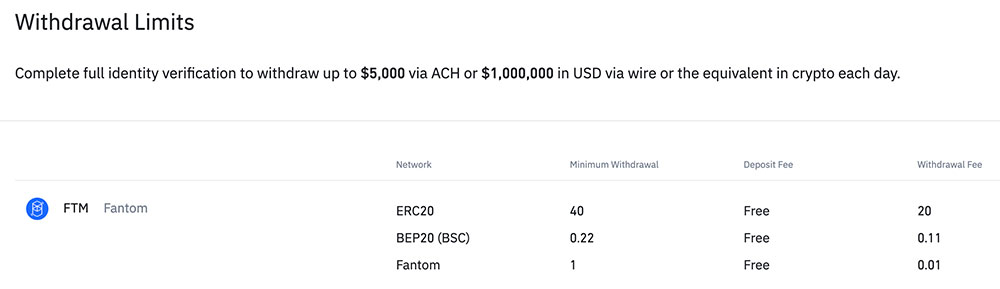

There’s also minimum withdrawal requirements to be aware of. These requirements will vary depending on the type of crypto you’re transacting with and the network you plan on transferring it to.

If you plan to withdraw your crypto, make sure you know the minimum requirements to get it out of the exchange. This might affect how much crypto you should buy in the first place if you plan on moving it outside of Binance.

For example, I wanted to withdraw 10 $FTM tokens to my MetaMask wallet to stake it with a protocol on the ETH network. To my surprise, I wasn’t able to make the withdrawal because I didn’t meet the minimum of 40 tokens for the ERC20 network. There’s also a hefty withdrawal fee of 20 FTM.

In this situation, you have the option to buy more $FTM so that you can meet the minimum withdrawal requirement. The other option is to withdraw on a different network like Fantom which has a minimum of only 1 token instead.

Binance is cheaper than Coinbase

As far as savings, here’s an example of how much you can expect to save on fees when using Binance instead of CoinBase:

Let’s say you want to buy $1000 of AVAX tokens on Coinbase, then send it to your digital wallet like MetaMask.

This will cost you roughly $15 in Coinbase fees (about 1.5% transaction fee), then another AVAX network fee on top of that to send it to your wallet.

However, if you were to go through the exact same process on Binance instead of Coinbase, you can expect to spend less than $1 in exchange fees.

That’s a lot of cheaper than $15.

The Binance mobile app works quite well if you prefer trading on your phone.

KuCoin Crypto Exchange

I’m just getting started with KuCoin. I’ll update this section as I learn more and can report back.

For starters, one cool thing about KuCoin is that they offer a welcome bonus gift.

First time customer bonus gift

All new users can claim one free drawing as part of a gift package with a value of up to 500 USDT. You are eligible to claim your free drawing after your first deposit or transfer of at least 50 USDT.

After signing up for a KuCoin account, check in the task center to get your free drawing and claim your prize. All drawing will guaranteed to win a prize.

Ways to earn with KuCoin

KuCoin has several ways for you to earn passively on their platform.

For example, you can deposit USDT stablecoin into KuCoin savings account to generate around ~6% APY interest.

You can also earn platform trading fee bonuses just for holding at least 6 $KCS tokens (the KuCoin platform’s native token).

More to come, stay tuned!