Cryptocurrency Terms for Beginners: A Friendly Guide

Cryptocurrencies have taken the world by storm, but many people find the jargon confusing. I’m here to help you make sense of it all.

Learning key cryptocurrency terms can help you understand this exciting new technology and make informed decisions about investing or using digital currencies.

As a beginner, you might feel overwhelmed by words like blockchain, mining, or wallets. Don’t worry! I’ll break down these terms in simple language. By the end of this post, you’ll have a solid grasp of the basics.

Ready to dive into the world of crypto? Let’s start with some essential terms that every newcomer should know. From Bitcoin to Ethereum, we’ll cover the most important concepts you need to understand.

Understanding the Basics

Cryptocurrency can seem confusing at first, but it’s not as complex as it might appear. Let’s break down the key concepts and terms to help you get started.

What Is Cryptocurrency?

Cryptocurrency is a digital form of money that uses special codes to keep it safe. It’s not like regular money that you can hold in your hand. Instead, it exists only on computers. Bitcoin was the first cryptocurrency, and it’s still the most well-known.

Cryptocurrency works on something called blockchain. This is like a big digital ledger that keeps track of all transactions. It’s super secure and hard to cheat.

One cool thing about cryptocurrency is that it’s decentralized. This means no single person or government controls it. Anyone can use it, no matter where they are in the world.

Common Terms and Definitions

Let’s look at some words you’ll often hear when talking about crypto:

- Blockchain: The technology that records all cryptocurrency transactions.

- Wallet: A digital place to store your cryptocurrency.

- Mining: The process of creating new cryptocurrency by solving complex math problems.

- Token: A unit of cryptocurrency, like one Bitcoin.

- Address: A unique code that acts like your account number for receiving crypto.

These terms might sound strange at first, but you’ll get used to them quickly. Don’t worry if you don’t understand everything right away. It takes time to learn all the lingo.

Cryptocurrency Types and Tokens

There are many different types of cryptocurrencies out there. Here are a few of the most important ones:

- Bitcoin (BTC): The first and most famous cryptocurrency.

- Ethereum (ETH): Known for its smart contracts and ability to run apps.

- Altcoins: Any cryptocurrency that isn’t Bitcoin.

Tokens are a special type of cryptocurrency. They often run on existing blockchain networks. For example, many tokens use the Ethereum network. These are called ERC-20 tokens.

NFTs (Non-Fungible Tokens) are another type of token. They’re unique digital items, often used for art or collectibles. They use standards like ERC-721 or ERC-1155.

Learning about different cryptocurrencies can be fun. Each one has its own features and goals. As you explore, you’ll find ones that interest you the most.

How Cryptocurrency Works

Cryptocurrency uses complex technology to create and manage digital money. Let’s explore the key parts that make it work.

The Role of Encryption

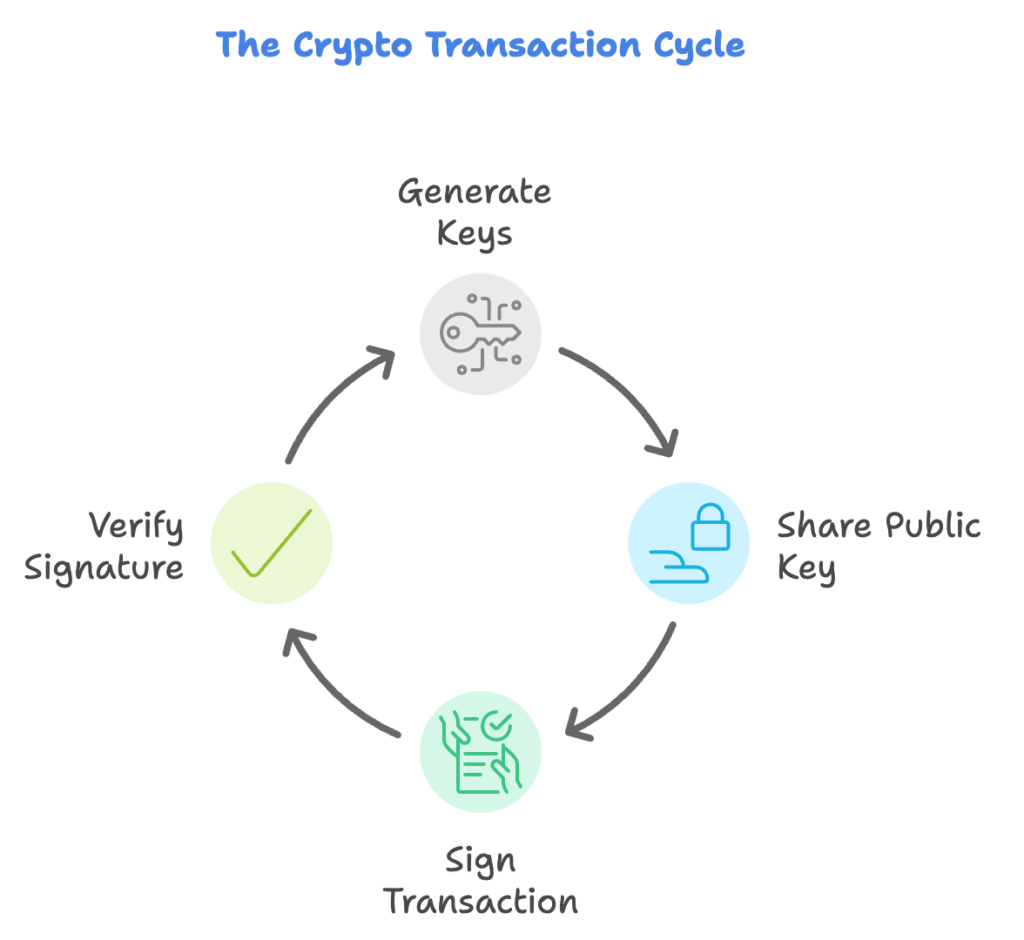

Encryption keeps crypto safe and private. I use a public key and a private key for transactions. My public key is like my email address – I can share it with anyone. My private key is secret, like a password. I use it to sign transactions.

Cryptography makes sure only I can spend my coins. It also checks that transactions are real. This stops people from copying or faking digital money.

When I send crypto, I “sign” it with my private key. Others can check it’s from me using my public key. This digital signature proves the transaction is mine.

The Blockchain Explained

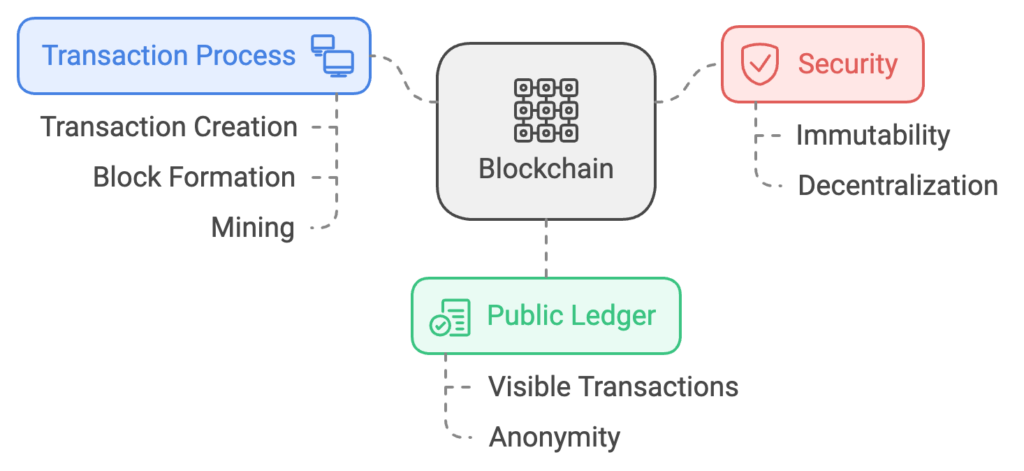

The blockchain is like a big digital record book. It keeps track of all crypto transactions. Every computer in the network has a copy of this book.

When I make a transaction, it goes into a “block” with other recent trades. Miners check these blocks are correct. Then they add the block to the chain.

Each block links to the one before it. This makes a long chain of blocks – the blockchain. I can’t change old transactions without changing every block after it. This makes the blockchain very secure.

The blockchain is public. I can see all transactions, but I can’t see who owns the accounts.

Mining and Validation

Mining adds new transactions to the blockchain. Miners are computers that solve hard math problems. This is called “proof of work.”

When a miner solves the puzzle, they can add a new block. They get new coins as a reward. This is how new crypto is made.

Some cryptos use “proof of stake” instead. People “stake” their coins to check transactions. They can lose their stake if they cheat.

Mining uses a lot of energy. Proof of stake uses less. Both methods help keep the network safe and running.

Consensus mechanisms like these make sure everyone agrees on which transactions are real. They stop people from spending the same coins twice.

Trading and Investing in Cryptocurrencies

Buying and selling crypto can seem tricky at first. I’ll explain some key terms and concepts to help you get started. We’ll look at common market lingo, different types of exchanges, and ways to keep your crypto safe.

Understanding Market Terms

When I started trading crypto, I quickly learned some important terms. Market cap shows a coin’s total value. It’s the price of one coin times the number of coins out there. ATH means “all-time high” – the highest price a coin has ever reached.

Volatility is how much prices go up and down. Crypto prices can change a lot in a short time. Liquidity means how easy it is to buy or sell without changing the price much.

Bull markets are when prices go up for a while. Bear markets are when they go down. These terms help me know what’s happening in the crypto world.

Types of Cryptocurrency Exchanges

I use different kinds of exchanges to buy and sell crypto. Centralized exchanges (CEX) are run by companies. They’re easy to use and have lots of coins. Binance is a popular CEX where I can trade crypto-to-crypto pairs.

Decentralized exchanges (DEX) don’t have a central authority. They let me trade directly with others. DEXs can be harder to use but give me more control.

I also look at things like fees, security, and which coins I can trade. Some exchanges let me trade crypto for fiat money like dollars or euros. Others only allow crypto-to-crypto trades.

Securing Your Investments

Keeping my crypto safe is super important. I use wallets to store my coins. Hot wallets are connected to the internet. They’re easy to use but less secure. Cold wallets are offline and much safer.

Hardware wallets are a type of cold wallet. They look like USB drives and keep my crypto offline. I never share my private keys – they’re like passwords for my wallets.

I make sure to research my chosen crypto before investing. It’s also smart to spread out my investments. This way, if one coin does poorly, I don’t lose everything. Staying informed about crypto news helps me make better choices too.

Frequently Asked Questions

Getting started with crypto can be confusing. I’ll cover some key terms and ideas to help beginners get up to speed. Let’s look at the basics everyone should know when diving into the world of cryptocurrency.

What are the basic concepts every crypto beginner should understand?

Cryptocurrency is digital money that uses special computer code to work. It’s not controlled by banks or governments. Instead, a network of computers keeps track of all transactions.

Blockchain is the technology behind crypto. It’s like a digital ledger that records every transaction. This makes crypto secure and hard to fake.

Which jargon words are essential for folks new to the crypto world?

Some key terms to know are:

- HODL: Hold On for Dear Life. It means keeping your crypto even when prices drop.

- FUD: Fear, Uncertainty, and Doubt. This refers to negative news that can scare investors.

- FOMO: Fear Of Missing Out. The urge to buy crypto because everyone else seems to be doing it.

What do the common acronyms in cryptocurrency stand for?

Here are some common acronyms:

- BTC: Bitcoin

- ETH: Ethereum

- ATH: All-Time High (highest price ever)

- ATL: All-Time Low (lowest price ever)

- DeFi: Decentralized Finance

What are some of the first terms beginners should learn about blockchain technology?

Important blockchain terms include:

- Node: A computer that helps run the blockchain network.

- Mining: The process of creating new crypto coins and verifying transactions.

- Smart Contract: Self-executing contracts with the terms written into code.

Can you list the fundamentals of cryptocurrency for someone just starting out?

Key fundamentals include:

- Decentralization: No central authority controls crypto.

- Limited Supply: Many cryptocurrencies have a max number of coins.

- Volatility: Crypto prices can change quickly and dramatically.

- Wallets: Digital storage for your crypto.

- Exchanges: Platforms where you can buy and sell crypto.

What are some humorous crypto terms and their meanings?

Crypto has some funny terms:

- Whale: Someone who owns a lot of crypto.

- Baghodler: A person stuck holding crypto that’s lost value.

- To the Moon: When crypto prices are expected to rise dramatically.

- Rekt: When you lose a lot of money in crypto trading.